February 2023 – Project Dormouse – Trees Planted

Last week a group of A C Mole staff joined [...]

February 2023 – Project Dormouse

For February’s pledge, we have turned our attention to the [...]

National Apprenticeship Week 2023

In the ever-changing pace of the working world, it is [...]

January 2023 – Warm Spaces at the Life Cafe – Getting involved

On Friday some members of A C Mole staff visited [...]

January 2023 – Warm Spaces at the Life Cafe

New year, new pledge! To kick start 2023 and to [...]

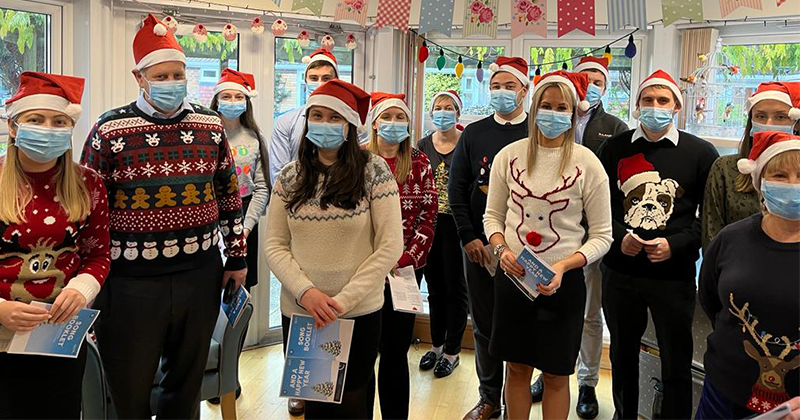

December 2022 – 120 Minutes Carol Singing – In fine voice

In December our 120 anniversary celebration pledge was to carry [...]

Further Delay to Making Tax Digital for Income Tax

Making Tax Digital (MTD) for Income Tax was due to [...]

December 2022 – 120 Minutes Carol Singing

With Christmas fast approaching, we wanted our December pledge to [...]

November 2022 – Open Door Taunton – Donations

During the month of November we have been collecting an [...]

Charity Seminar 2022

On Monday 28 November 2022 we held our annual Charities [...]

Autumn Statement 2022

Following months of turmoil and weeks of speculation, The Chancellor [...]

November 2022 – Open Door Taunton

As an extension of Octobers pledge to support Taunton Foodbank, [...]

October 2022 – Taunton Foodbank – Donations

As an ongoing part of our 120 year celebrations, this [...]

Changing VAT return penalty regime

The way HM Revenue & Customs charge VAT penalties is [...]

October 2022 – Taunton Foodbank

In order to celebrate the achievement of reaching 120 years, [...]

A C Mole turns 120 years

“One of the South West’s leading independent Accountancy firms A [...]

Mini budget 2022

The country has faced significant change over the last few [...]

The Charities Act 2022 – What changes are coming?

The Charities Act 2022 updates the 2011 Act and has [...]