The chancellor of the Exchequer Jeremy Hunt presented the Government’s 2023 Budget on Wednesday 15 March.

a fairly mundane Budget

We were expecting, and were delivered, a fairly mundane Budget with only a small number of tax changes which, after the volume of changes and reversal of changes last Autumn, was gratefully received.

Economy and Public Finances

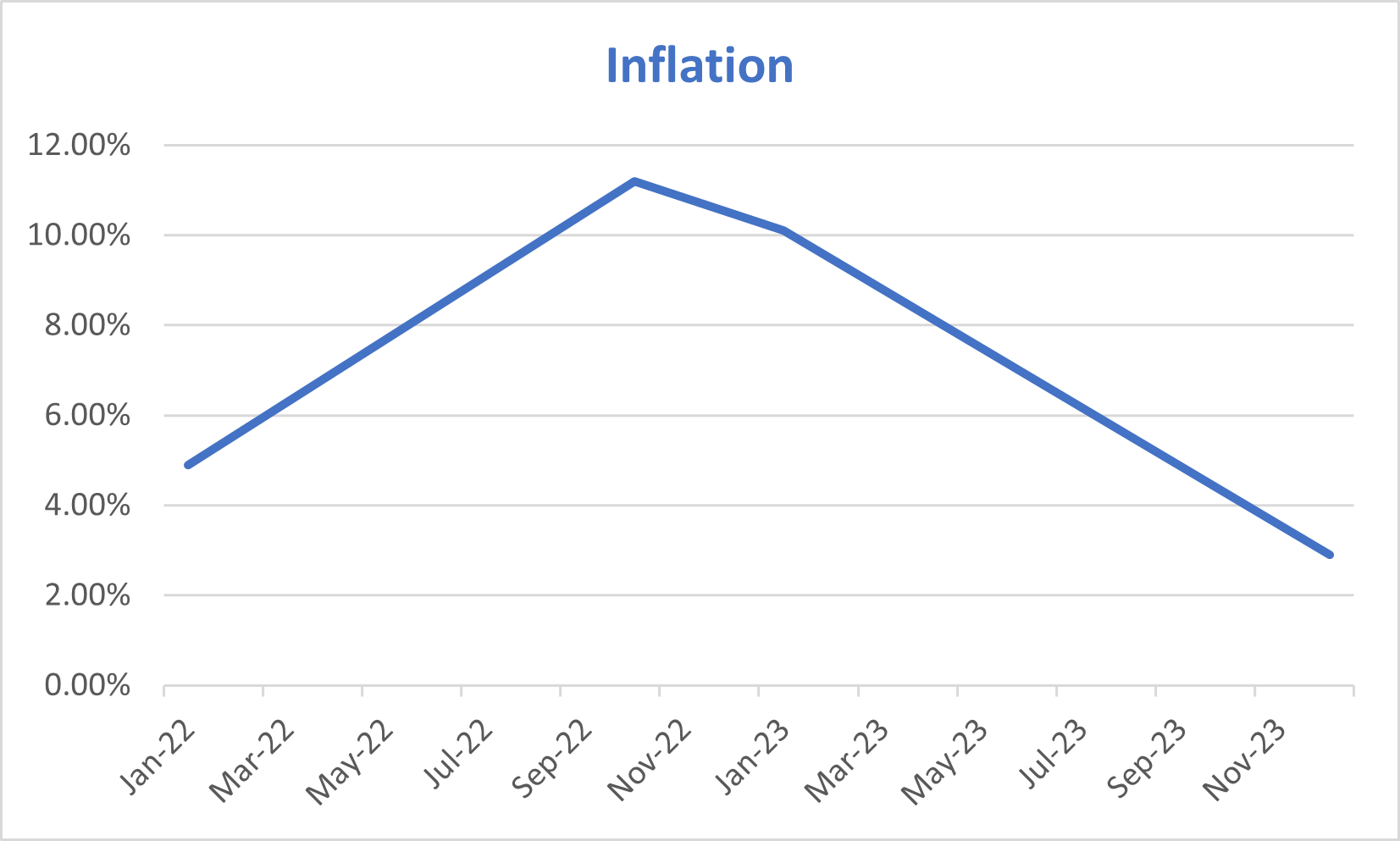

The Government’s target inflation rate continues to be 2%. Inflation hit its highest level in 40 years last October of 11.1% but this has now started to fall and stood at 10.1% at the end of January 2023.

The Office of Budget Responsibility (OBR) is forecasting a significant fall in inflation during the year, anticipating a rate of 2.9% by the end of the year.

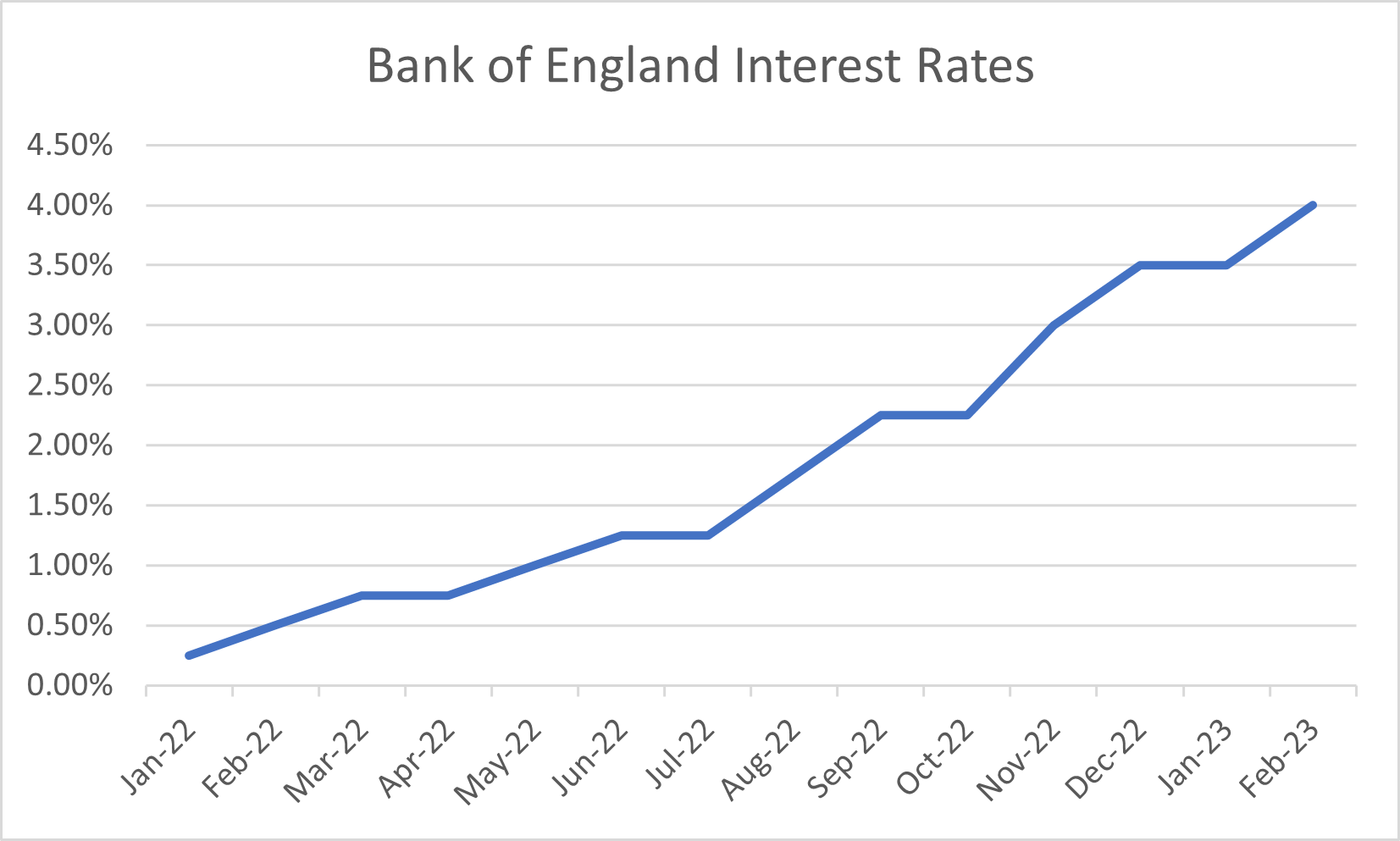

The Bank of England is tasked with helping to control inflation through base rate changes and in February the base rate increased to 4%. This was the eighth increase in base rate in the last 12 months.

Growth in Gross Domestic Product has been better than the OBR was originally predicting and we are now expecting to avoid a technical recession. However, the OBR is still predicting negative growth on an annual basis for 2023 of -0.2%. The longer-term growth forecasts are 1.8% for 2024, 2.5% for 2025, 2.1% for 2026 and 1.9% for 2027.

Government borrowing continues to be high and total debt currently stands at £2.5trillion. Although UK debt is forecast to reduce as a percentage against GDP there is still an annual borrowing requirement for the foreseeable future which adds to the UK total debt position.

Tax Announcements were few and far between

The main personal tax announcements were in part leaked prior to the Budget presentation and revolved around the aim of retaining over 50’s in the UK workforce. In particular, the pension annual allowance will increase from £40,000 to £60,000 and the lifetime allowance cap will be abolished from 6 April 2023.

The pension annual allowance will continue to be tapered but the adjusted income threshold for tapering purposes will increase from £240,000 to £260,000 and the minimum tapered annual allowance will increase from £4,000 to £10,000 from 6 April 2023.

There were very few other new personal tax announcements, as the Chancellor had announced last Autumn that the personal allowance, higher rate threshold and National Insurance thresholds would be frozen for an extra 2 years until April 2028.

In the 2022 Autumn statement the Chancellor also announced that, as from 6 April 2023, the additional rate threshold will fall from £150,000 to £125,140, the dividend allowance will fall from £2,000 to £1,000 and the capital gains tax annual exemption will fall from £12,300 to £6,000.

Inheritance Tax was completely absent from the Chancellor’s speech but he already had announced in the 2022 Autumn statement that the nil-rate band and residence nil-rate band would be frozen at £325,000 and £175,000 respectively until 2028.

Business Tax Announcements

The previously announced increase in the Corporate tax rate from 19% to 25% comes into effect from 1 April 2023. Companies with taxable profits below £50,000 will continue to suffer corporation tax at 19%, with profits falling between £50,000 and £250,000 being taxed at a marginal rate.

The biggest announcement of the budget that had not already been leaked was in connection with capital allowances.

The super-deduction will cease as planned on 31 March 2023 but will be replaced by ‘Full Expensing’ whereby companies will be able to deduct 100% of the cost of certain plant and machinery from their profits before tax (treated as a first-year allowance ). Full Expensing will currently run for 3 years from 1 April 2023 but the Chancellor stated that it is the Government’s aim for this relief to be permanent.

The 50% first-year allowance (FYA) that was introduced with the super-deduction (and was due to cease on 31 March 2023) will be extended by three years but, as with Full Expensing, the Chancellor’s aim is for this relief to be permanent. The FYA applies to plant and machinery classified as special rate assets and, as with Full Expensing, is only available to companies.

In the 2022 Autumn Budget the Chancellor also announced that the Annual Investment Allowance will be permanently set at £1m. The Annual Investment Allowance is available to all businesses (unlike Full Expensing and FYA which is only available to companies) and applies to all plant and machinery, including special rate assets.

VAT was, like Inheritance Tax, completely absent from the Chancellor’s speech. The rate of VAT therefore remains at 20% and the registration and deregistration thresholds of £85,000 and £83,000 respectively remain frozen until 2026.

Other Tax Announcements

The Research and Development scheme has once again been tinkered with. As previously announced the additional deduction for research and development for small and medium sized business (SME’s) will decrease from 130% to 86%, the tax credit rate will decrease from 14.5% to 10% and the Research and Development Expenditure Credit will increase from 13% to 20% for expenditure incurred on or after 1 April 2023. A further change was announced in the budget for R&D intensive companies (SME’s where 40% of total expenditure is R&D qualifying expenditure) whereby the tax credit rate will be 14.5%.

Our full tax rates card can be downloaded here.

For more information please contact us.